IRS Levy

Employer Duties Regarding IRS Levies

When an employee fails to satisfy his or her tax liabilities, the IRS has an array of administrative tools that it can call upon to enforce collections upon the taxpayer. One method of enforced collections is to levy the taxpayer’s wages. The Internal Revenue Code contains provisions that require employers to help the IRS in its tax collection efforts.

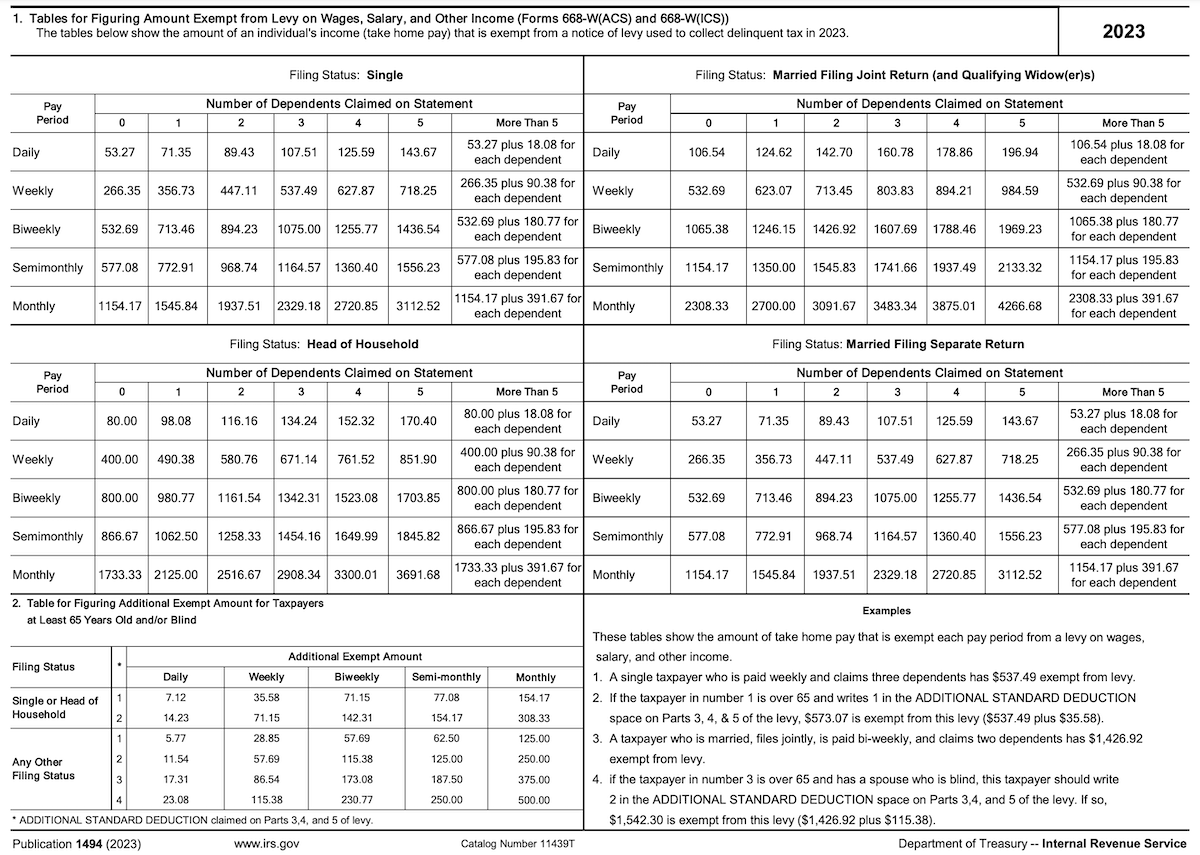

IRC § 6332 provides that “any person in possession of (or obligated with respect to) property or rights to property subject to levy upon which a levy has been made shall, upon demand of the Secretary, surrender such property or rights … to the Secretary.” Employers are within the category of persons required to comply with a levy. Upon receiving an IRS levy against an employee, the employer must withhold and remit amounts contained in the IRS table. This table is included with this article, or it can be found in IRS Publication 1494 . Employers are to continue to garnish an employee’s wages until either the outstanding tax liability has been satisfied or the levy is released.

This point was recently affirmed in a case where the court held not only that section 6332(e) precluded the taxpayer from seeking relief against his employer but also, more broadly, held that, “Even where a levy is determined to be invalid, the custodian of the property is still immune from liability from actions arising from its compliance with the levy” (Hunter v. University of Louisville, No. 2010-CA-001613-MR, slip op. at 4 (Ky. Ct. App. 8/5/11)).

Employers do not have much of a choice in deciding whether to comply with an IRS levy. The employer has much to lose and nothing to gain from noncompliance. Employers should nonetheless be aware of their legal responsibilities to both the IRS and their employees in dealing with levies.

Interested in our services? We've got you covered!

Reach out today to learn more about how to get started.